NEC Research Institute Technical Report #2000-168.

A brief version appears in Science 291:

987-988, February 9 2001 (Letters).

The Power of Play: Efficiency and Forecast Accuracy in Web Market Games

David M. Pennock

NEC Research Institute

4 Independence Way

Princeton, NJ 08540 USA

dpennock@research.nj.nec.com

voice: 609-951-2715

fax: 609-951-2488

Steve Lawrence

NEC Research Institute

4 Independence Way

Princeton, NJ 08540 USA

lawrence@research.nj.nec.com

C. Lee Giles

School of Information Sciences and Technology and

Department of Computer Science and Engineering

Pennsylvania State University

504 Rider Building, 120 South Burrowes Street

University Park, PA 16801 USA

giles@ist.psu.edu

Finn Årup Nielsen1

Informatics and Mathematical Modelling

Technical University of Denmark, Building 321

DK-2800 Lyngby, Denmark

fn@imm.dtu.dk

Abstract:

We analyze the efficiency and forecast accuracy of two market games on

the World Wide Web: the Hollywood Stock Exchange (HSX) and the

Foresight Exchange (FX). We quantify the degree of arbitrage

available on HSX, and compare with a real-money market of a similar

nature.

We show that prices of HSX movie stocks provide good forecasts of

actual box office returns, and that prices of HSX securities in Oscar,

Emmy, and Grammy award outcomes constitute accurate assessments of the

actual likelihoods that nominees will win. Similar investigations

reveal that FX securities prices serve as reliable indicators of

uncertain future events.

We argue that, in certain circumstances, market simulations can

furnish some of the same societal benefits as real markets, and can

serve as acceptable substitute testbeds for conducting experiments

that would otherwise be difficult or impossible.

- Keywords:

- analysis of artificial markets, World Wide Web market

games, market simulations, forecast accuracy, economic efficiency,

arbitrage, Hollywood Stock Exchange, Foresight Exchange, utility for

intangibles

Introduction

The core service of a market is to facilitate the exchange of items

between individuals.

The use of prices for these items, denominated in a common

currency (e.g., US dollars), simplifies trading across multiple

markets, alleviating the combinatorial nature of direct barter. Prices

reflect an agreement between buyers and sellers, and serve as a

quantitative measure of the value of the item being exchanged, as

compared to other marketable items.

When markets attract broad participation, prices can encode the sum

total of a large amount of disparate and distributed information. The

prices reflect, in a very real sense, the consensus opinion of a myriad

of informed and well-motivated traders. As such, even nonparticipating

observers may stand to benefit from the informational value of market

signals. As an example, the odds in a horse race, determined solely by

market forces at the track, can be viewed as assessments of the

likelihoods that the various horses will win. Empirical studies verify

that odds on horses do indeed match very closely with their observed

frequencies of winning

[1,18,19,20,22].

As traditional markets expand onto electronic platforms, and as new

electronic marketplaces emerge, price information will be available and

accessible in quantities previously unimaginable. Nevertheless, markets

will still only cover a miniscule fraction of arenas for which informed

forecasts might be valuable or interesting. Many barriers exist for the

establishment of new markets, including high costs, government

regulation, and the threat of lawsuits.

Artificial markets, on the other hand, suffer from no such

difficulties. Web market games, in particular, often feature moderate

operating costs for setup, maintenance, advertising, searching, and

transacting, and benefit from worldwide audience potential. Permission

is not required from government authorities or regulatory officials.

Lawsuits are much less of a concern. There is little need for

carefully crafted disclaimers or facilities for dispute

resolution. Users can remain anonymous, and record keeping can be

somewhat lax. All of these factors have contributed to a growing

prevalence of market games on the web, some enjoying widespread

popularity. Of course, artificial markets cannot satisfy societal

demand for the exchange of items. However, in this paper we present

evidence that some market simulations can function reasonably well in

the dual role as aggregators and disseminators of information.

Theories of market equilibrium, including the rational expectations

theory of information propagation, usually depend on the assumption

that participants maximize expected utility, where utility is derived

from consumables or monetary equivalents. Indeed, laboratory economics

experiments in which subjects are not ``paid to play'' are often

questioned on the grounds of a lack of true incentives. In a game

without monetary backing, utility is presumably extracted solely from

entertainment value, educational value, bragging rights, and/or other

intangible sources. Does market efficiency simply break down under

these conditions, or can non-monetary rewards actually drive price

coherence, information aggregation, and forecast accuracy? We find

evidence that, in some cases, they can and they do. In

Section 3 we quantify price coherence on the

Hollywood Stock Exchange (HSX). Equivalent portfolios trade at

reasonably consistent prices, and, over time, large inefficiencies

disappear, as players presumably take advantage. In

Section 4 we evaluate the collective competence of

traders on HSX and on the Foresight Exchange (FX), by measuring the

prescient value of market prices. In doing so, we find

that HSX stock prices are reliable indicators of what movies will do

well at the box office,

that HSX award option prices provide accurate assessments of which

nominees will likely win entertainment awards,

and that FX prices constitute accurate probabilistic judgments for a

variety of uncertain future events.

An economist strolling down Wall Street spots a twenty dollar bill

lying on sidewalk, but decides not to pick it up. No, this particular

economist is not simply too rich to be bothered. Rather, he concludes

without checking that the bill is a forgery. ``If it were a real

twenty dollar bill,'' he reasons, ``someone else would have picked it

up already.'' This widely told joke exemplifies what is called the

efficient markets hypothesis. Roughly speaking, the hypothesis

claims that there are no free lunches in the financial markets: every

potential profit comes with some amount of risk, and prices are

inherently unpredictable. If there is a risk-free profit momentarily

available, or if prices are predictable, then someone will take

advantage of the opportunity almost instantly, exploiting it until it

is gone. There are various forms of the efficient markets hypothesis,

and at least four different degrees of efficiency to consider:

- Internal coherence: prices are self-consistent or

arbitrage-free: no trader can make a sure profit without any risk.

- Internal unpredictability: future prices are not

predictable based on current and past prices. Also called the weak

form of the efficient markets hypothesis.

- Unpredictability: future prices are not predictable based

on any currently available information, including prices, economic

variables, fundamental data, etc. Also called the semi-strong form of

the efficient markets hypothesis.

- Expert-level accuracy: Prices fully reflect all

information available to all traders. Informed experts cannot

consistently outperform naive traders. In particular, when prices

constitute forecasts, market estimates are at least as accurate as

expert assessments. Also called the strong form of the efficient

markets hypothesis.

Economists have developed a large body of theory to account for all

four levels of market efficiency. And empirical evidence

verifies--for the most part--that markets are indeed largely absent

of arbitrage, are highly unpredictable, and can yield extremely

accurate forecasts.

In this paper, we examine artificial markets for the same signs of

efficiency, focusing on the first and fourth types: internal coherence

and expert-level accuracy. We survey additional background material on

these two forms of efficiency in Sections 2.1.1

and 2.1.2, respectively.

Internal Coherence: No-Arbitrage

Almost all economic theories of equilibrium assume, at a minimum, that

equivalent portfolios are priced consistently with one another, such

that arbitrage opportunities do not exist

[2,3,11].2

Many important results of financial economics are based squarely on

the hypothesis of no arbitrage, and it serves as one of the most basic

unifying principles of the study of financial markets. [21]

For example, if the same company's stock is listed on both the Tokyo

and New York stock exchanges, then the two prices should be the same

at all times, modulo the exchange rate and transaction costs. If the

prices do ever diverge significantly, traders will purchase the stock

in the cheaper market and immediately sell it in the more expensive

market, thereby driving the two prices back together. As a second

example, monetary exchange rates should never be such that a ``round

trip'' from one currency through one or more others and back again

yields a positive gain.

A third example arises in the context of a securities

market. In the parlance of economic theory, a security is

defined as a lottery ticket that pays off $1 contingent on the

outcome of some uncertain event. For example, the owner of a security

``$1 if and only if it rains tomorrow'' will be paid $1 if it rains

tomorrow, and nothing otherwise.3 Now imagine a market of two

disjoint and exhaustive securities: ``$1 if and only if it rains

tomorrow'' and ``$1 if and only if it does not rain

tomorrow''. Owning both securities guarantees the holder a payoff of

exactly $1 regardless of whether it rains. Thus the total price to

buy both securities should never dip below $1--otherwise, the buyer

can obtain a risk-free profit. Similarly, in the absence of arbitrage,

the total price to sell both securities can never exceed $1.

We will examine a fourth example in Section 2.2, where

no-arbitrage implies that prices of a stock and its corresponding

options must conform to a relationship called put-call parity.

Expert-Level Forecast Accuracy: Rational Expectations

The theory of rational expectations (RE) equilibrium accounts

for expert-level forecast accuracy in securities markets. RE theory

posits that prices are not only coherent, but also reflect the sum

total of all information available to all market participants

[6,10]. Even when some agents have exclusive access

to inside information, prices equilibrate exactly as if everyone had

access to all information. The procedural explanation is that prices

reveal to the ignorant agents any initially private information; that

is, agents learn by observing prices. Several authors show that, if

agents begin with identical priors and disparate evidence, repeated

observation of some aggregate statistic (e.g., price) will converge to

a consensus on posteriors, for various sufficient statistics

[7,12,13,14].

Plott et al. [15] investigate, in a laboratory

setting, whether parimutuel markets (the type employed at horse races)

are able to aggregate information, as postulated by RE theory. In one

set of experiments, each subject was given inside knowledge that a

subset of horses would definitely not win. Although all subjects

were uncertain as to the outcome, their collective information was

enough to identify the winning horse with certainty. Information

aggregation did occur, and RE-based predictions fit the data well.

In earlier work, Plott and Sunder [16,17]

conducted laboratory experiments to test the reasonableness of the RE

assumption in the context of a securities market. Subjects were

initially unaware which of three states would occur.

In one study [16], privileged insiders were given

categorical knowledge of the underlying state. The RE model's

predictions--that equilibrium prices and other economic variables

converge as if everyone were aware of the true state--were

significantly more accurate than those of other models, including the

classical Walrasian hypothesis that agents do not revise their beliefs

based on prices. When insiders were given less than certain

information, the results were not definitive. In a second study

[17], insiders were told only that one of the three

states would not occur. The combined knowledge of all subjects

was sufficient to logically infer the true state, though no single

insider could directly do so. It was found that, in a complete market

of three securities, the RE predictions were again the most accurate.

In a single security market,

the RE equilibrium was not realized. On the other hand, even in this

last condition, Forsythe and Lundholm [4], with a

similar experimental design, found that RE was verified as long as

subjects were sufficiently experienced and knowledgeable.

Beyond the controlled setting of the laboratory, empiricists have

analyzed the forecast accuracy of public markets. Perhaps the most

direct tests involve horse race betting markets. Several studies

demonstrate that odds on horses correlate well with the actual

frequencies of victory

[1,18,19,20,22]. There does appear

to be a small but consistent bias: favorites are underpriced and

longshots are overpriced. Weitzman [22] and Ali

[1] show how an assumption that the crowd as a whole is

risk-seeking can explain this favorite-longshot bias. Beyond horse

racing, sports betting markets as a whole provide very accurate

forecasts of likely game outcomes.

The Iowa Electronic Market

(IEM)4 supports

trading in securities tied to the outcome of political and financial

events. Their 1988 market, open only to University of Iowa students

and employees,

offered securities that paid off proportionally to the percentage of

votes received by various candidates in that year's US Presidential

election. The final prices matched Bush's final percent margin of

victory more closely than any of the six major polls

[5]. Since opening to the public, subsequent US

Presidential election markets have attracted wide participation and

following. Other election markets have now opened in

Canada5 and Austria.6

The Hollywood Stock Exchange

The Hollywood Stock Exchange (HSX)7

is a popular online market simulation, with approximately 400,000

registered accounts. New accounts begin with H$ two million in

``Hollywood dollars''. Participants can buy and sell movie stocks,

star bonds, movie options, and award options. The current top

portfolio is worth just over H$1 billion. High ranking portfolios are

actually sold at auction on Ebay8

for real money on a regular basis. Based on these sales, the

``exchange rate'' seems to be approximately H$1 million to US$1,

with the rate increasing for higher ranked portfolios. HSX is

beginning to offer new investment opportunities backed with real

money. For example, HSX investors could purchase shares in the movie

American Psycho for H$1 million each; these shares paid off

about US$1 for every US$5 million of the movie's box office

proceeds. HSX cofounder Max Keiser hosts a weekly radio broadcast in

Los Angeles, and appears regularly on NBC's Access Hollywood to

discuss HSX information. HSX also sponsors a booth at the Sundance

Film Festival, and holds an annual Oscar party in Hollywood. Media

reports suggest that HSX prices are taken seriously by some Hollywood

insiders.

Although the current price of any HSX movie stock is based on the

collective whims of HSX traders, the value of the stock is ultimately

grounded in the corresponding movie's performance at the box

office. Specifically, after the movie has spent four weeks in release,

the stock delists and cashes out: shareholders receive H$1 per share

for every US$1 million that the movie has grossed up to that point in

the US domestic market, as reported by ACNielsen EDI,

Inc.9 Traders buy (resp., short

sell) stocks that they believe underestimate (overestimate) the

movie's eventual performance. The current price, then, is a collective

forecast of the movie's four-week box office

returns.10

The prices of some stocks adjust after their first weekend in wide,

national release. On Friday, trading in the stock is halted; on

Sunday, the price adjusts to H$2.9 times the movie's weekend box

office numbers (in US$ millions).11 In this case, the stock's price

prior to wide release is the HSX traders' forecast of 2.9 times the

movie's opening weekend proceeds. The 2.9 factor is meant to project

the movie's four week total based on its opening weekend results.

HSX often offers call and put options in nationally released

movies. Each option has an associated (constant) strike price  ,

which is a crude estimate of the movie's opening weekend return

,

which is a crude estimate of the movie's opening weekend return

. On the Friday of opening weekend, options trading is halted; on

the following Monday, call options delist and cash out at a price

equal to the weekend proceeds (in millions) minus the strike price, or

zero if this quantity is negative (i.e.,

. On the Friday of opening weekend, options trading is halted; on

the following Monday, call options delist and cash out at a price

equal to the weekend proceeds (in millions) minus the strike price, or

zero if this quantity is negative (i.e.,

![$\max[0, r - k]$](img6.png) ). Put

options cash out at

). Put

options cash out at

![$\max[0, k - r]$](img7.png) . A high call price (resp., a high

put price) suggests that, according to HSX participants, the movie

will earn more (less) than the strike price during its opening

weekend.

. A high call price (resp., a high

put price) suggests that, according to HSX participants, the movie

will earn more (less) than the strike price during its opening

weekend.

The payoff structure of HSX movie options is analogous to so-called

European options in the financial markets. In an arbitrage-free

market, when a movie stock, a call option, and a put option are all

available for the same movie, the three prices must conform to a

relationship called put-call parity:

, where

, where  ,

,

,

,  , and

, and  are the stock, strike, call, and put prices,

respectively. Consider the value of the following two portfolios: (1)

twenty nine call options plus H$29

are the stock, strike, call, and put prices,

respectively. Consider the value of the following two portfolios: (1)

twenty nine call options plus H$29 in cash, and (2) twenty nine

put options plus 10 shares of the stock. After the weekend, portfolio

1 will be worth

in cash, and (2) twenty nine

put options plus 10 shares of the stock. After the weekend, portfolio

1 will be worth

![$29k + 29\max[0, r-k] = \max[29k, 29r]$](img11.png) while

portfolio 2 will be worth

while

portfolio 2 will be worth

![$\max[0, k-r] + 10(2.9r) = \max[29r,

29k]$](img12.png) . Since the two portfolios pay off equivalently, their prices at

any time before the weekend should be equal; otherwise, a trader can

buy the cheaper portfolio and short sell the other, locking in a

guaranteed profit.12

. Since the two portfolios pay off equivalently, their prices at

any time before the weekend should be equal; otherwise, a trader can

buy the cheaper portfolio and short sell the other, locking in a

guaranteed profit.12

Occasionally, HSX offers securities (which they call award options)

associated with particular awards ceremonies--for example, the 72nd

Annual Academy Awards, or Oscars, sponsored by the Academy of

Motion Picture Arts and Sciences. Five options, corresponding to the

five award nominees, are available within each award category (for

example, Oscar award options were available for each of the eight

major Oscar categories of best picture, best actor, best actress, best

supporting actor, best supporting actress, best director, best

original screenplay, and best adapted screenplay). Within each

category, the winning option cashes out at H$25, and the other four

cash out at H$0. Before awards are announced, an option's price can

be interpreted as its estimated likelihood of winning. For example,

when Kevin Spacey's price was twice that of Denzel Washington, the

consensus of HSX opinions was that Spacey was roughly twice as likely

to win as Washington. By normalizing prices within each category,

likelihoods can be converted into probabilities. Notice that, since it

is certain that one and only one of the five options within a

particular category will pay off H$25, the bundle price of all five

options should be worth H$25 at all times. If the combined price ever

dips below H$25, a participant could guarantee an arbitrage profit by

purchasing all five and waiting (if necessary) until the winner is

announced, at which time he or she can pocket the difference. If the

combined price ever moves above H$25, participants can guarantee a

profit by short selling all five options.

Internal Coherence in Artificial Markets

In a real market, monetary incentives are the driving force behind

efficiency and, in particular, internal price coherence. In an

artificial market, on the other hand, there are no direct monetary

incentives. When an arbitrage loophole presents itself in a

simulation, why should anyone care to take advantage of it? Incentives

must come from intangible sources (e.g., the desire to perform well in

the game) or from indirect sources (e.g., the desire to do well enough

to sell one's portfolio on Ebay). Do HSX players have utility for

Hollywood dollars and, if so, are their resulting incentives strong

enough to maintain internal price consistency in the game?

To analyze these questions, we quantify the degree of coherence in the

HSX stock and options markets (Section 3.1), and

in the HSX award options market

(Section 3.2).

Put-Call Parity

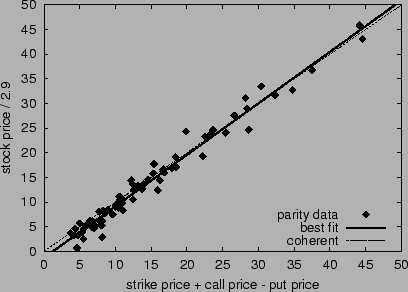

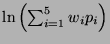

We test how closely HSX stock and options prices conform to put-call

parity. We gathered weekend halt prices (i.e., prices after Friday's

halt and before the weekend adjust) for 75 movie stocks and their

corresponding options appearing on HSX during the period of March 3,

2000 to September 1, 2000. Figure 1 graphs the

stock estimate of weekend box office returns ( ) versus the

options estimate (

) versus the

options estimate ( ). In an arbitrage-free market, the two

estimates must be the same. The figure demonstrates a reasonably close

adherence to put-call parity at price halt. The correlation between

the two estimates is 0.989, the slope of the best-fit line to the data

(the solid line in the figure) is 1.04, and the mean difference

between estimates is 1.35. Any point in the figure not lying on the

line

). In an arbitrage-free market, the two

estimates must be the same. The figure demonstrates a reasonably close

adherence to put-call parity at price halt. The correlation between

the two estimates is 0.989, the slope of the best-fit line to the data

(the solid line in the figure) is 1.04, and the mean difference

between estimates is 1.35. Any point in the figure not lying on the

line  (the dashed line) indicates a potential arbitrage

opportunity. Since HSX restricts each player's investment to a maximum

of 10,000 shares of any option, exploiting all of these inefficiencies

averages about H$13,500 per movie--a relatively small, though

non-negligible, amount in terms of the game.

(the dashed line) indicates a potential arbitrage

opportunity. Since HSX restricts each player's investment to a maximum

of 10,000 shares of any option, exploiting all of these inefficiencies

averages about H$13,500 per movie--a relatively small, though

non-negligible, amount in terms of the game.

Figure 1:

Put-call parity in the HSX stock and options markets at

price halt. Points plot  versus

versus  for each movie.

The dashed line where

for each movie.

The dashed line where  corresponds to perfect

parity; the solid line is the best linear fit.

corresponds to perfect

parity; the solid line is the best linear fit.

|

In an efficient market, prices should adhere to put-call parity at

all times, not just at price halt. Moreover, any movements away from

parity that do occur should revert rather quickly, as participants

take advantage of arbitrage opportunities. We test these hypotheses by

measuring the divergence from parity over time, and the likelihood of

closure toward parity. For each stock and its corresponding options,

we recorded the quantity  every four hours. This quantity

is the divergence from parity, or the available arbitrage per option

share, or the price of a portfolio of H$1 cash, one call option, a

short position in one put option, and a short position in

every four hours. This quantity

is the divergence from parity, or the available arbitrage per option

share, or the price of a portfolio of H$1 cash, one call option, a

short position in one put option, and a short position in  stocks. We sorted the resulting 971 portfolio prices, and grouped them

into ten buckets: nine buckets with exactly 100 portfolios each, and

the last with the remaining 71. Within each bucket, we computed the

fraction of portfolios that were observed at a higher price four hours

later, and the fraction of portfolios that were lower in price four

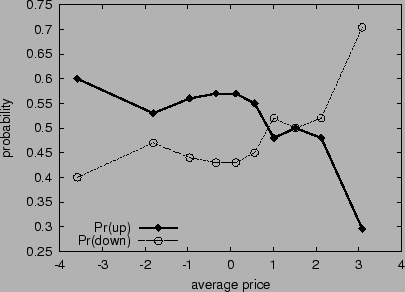

hours later. Figure 2 graphs the frequency of

upward and downward movements versus the average price. Points marked

as diamonds indicate the frequency of an upward shift at the next time

step, given the average current price; points marked as circles

indicate the frequency of a downward shift at the next time step,

given the average current price. The market is not completely free of

arbitrage--prices diverge at times from parity by as much as

H$6.5. Nevertheless, the market does exhibit signs of internal

coherence. When prices are too high, they are much more likely go down

at the next time step as, presumably, participants take advantage of

arbitrage opportunities. When prices are too low, they are more likely

to increase. Large deviations from coherent prices might be partially

explained by trading limits of 10,000 option shares per person, so

that even astute and ``wealthy'' investors cannot fully exploit

arbitrage windows.

stocks. We sorted the resulting 971 portfolio prices, and grouped them

into ten buckets: nine buckets with exactly 100 portfolios each, and

the last with the remaining 71. Within each bucket, we computed the

fraction of portfolios that were observed at a higher price four hours

later, and the fraction of portfolios that were lower in price four

hours later. Figure 2 graphs the frequency of

upward and downward movements versus the average price. Points marked

as diamonds indicate the frequency of an upward shift at the next time

step, given the average current price; points marked as circles

indicate the frequency of a downward shift at the next time step,

given the average current price. The market is not completely free of

arbitrage--prices diverge at times from parity by as much as

H$6.5. Nevertheless, the market does exhibit signs of internal

coherence. When prices are too high, they are much more likely go down

at the next time step as, presumably, participants take advantage of

arbitrage opportunities. When prices are too low, they are more likely

to increase. Large deviations from coherent prices might be partially

explained by trading limits of 10,000 option shares per person, so

that even astute and ``wealthy'' investors cannot fully exploit

arbitrage windows.

Figure 2:

Arbitrage closure toward put-call parity in the HSX stock

and options markets. Each diamond point (resp., circle point)

displays the fraction of portfolios that move up (down) in price

after four hours, versus the average current price.

|

Award Options

In this section, we analyze price coherence in the HSX award options

market. In an efficient market, the combined price for a bundle of

options in the same award category would remain at H$25 at all

times. We examine the actual prices of options in the Oscar and Emmy

awards markets for deviations from H$25, and for the likelihood of

closure toward H$25. We recorded the sum of the five options within

each category every four hours from March 3 to September 1, 2000. We

sorted the resulting 1895 bundle prices, and merged them into ten

buckets: nine buckets with exactly 200 bundles each, and the last with

the remaining 95. Within each bucket, we computed the fraction of

bundles that were observed at a higher price four hours later, and the

fraction of bundles that were lower in price four hours later.

Figure 3 graphs the frequency of upward

and downward movements versus the average price.

Prices diverge at times from H$25 by close to 40%, yet a clear trend

is evident whereby highly underpriced and overpriced bundles are

likely to revert toward the coherent price. Notice that the crossover

point, where up and down swings are equally likely, occurs above

H$25. We postulate that this is because participants generally prefer

to buy rather than to sell short.

Figure 3:

Arbitrage closure in the HSX Oscar and Emmy options

markets. Each diamond point (resp., circle point) displays the

fraction of bundles that move up (down) in price after four hours,

versus the average current price.

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=hsx-a...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img18.png) |

Figure 4:

Arbitrage closure in the IEM NY Senate market.

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=iem-n...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img19.png) |

For comparison, we conducted a similar arbitrage analysis using data

from the Iowa Electronic Market (IEM), a real-money exchange offering

securities in political events. We obtained daily closing prices for

the NY Senate market, still in progress as of this

writing. Participants can buy or sell shares of six securities:

``US$1 if and only if Hillary Clinton wins the election'', ``US$1 if

and only if another Democrat wins'', ``US$1 if and only if Rick Lazio

wins'', ``US$1 if and only if Rudy Giuliani wins'', ``US$1 if and

only if another Republican wins'', and ``US$1 if and only if any

other candidate wins''. In order for the market to be arbitrage free,

the sum of the bid prices of the six securities cannot exceed US$1,

and the sum of the ask prices cannot fall below US$1. We did not have

access to bid and ask prices, so we performed the calculations using

the last transaction prices; this provides an upper bound on the

amount of arbitrage in the market. We sorted bundles by price and

grouped them into buckets. We computed the fraction of bundles in each

bucket that were up the next day, and the fraction that were down.

Figure 4 displays the results. Maximum

deviations from US$1 were approximately 6%. Low prices were very

likely to move upward the next day, high prices very likely to turn

back downward. Interestingly, the crossover point is still above

US$1, suggesting that perhaps even in IEM there is a preference for

buying over selling. There are also effective trading limits in IEM,

since participants can join the market with a maximum US$500

investment. Comparing Figures 3

and 4, it is clear that IEM prices are more

coherent than HSX prices, as one might expect, given that the former

is grounded in real money while the latter is not. Nevertheless, the

general shape of the two plots are similar.

Forecast Accuracy in Artificial Markets

Internal price coherence is one, fairly minimal, standard of market

efficiency. Stronger forms of efficiency imply market competence as

well and coherence: prices actually reflect an aggregation of

information distributed among the participants, and market forecasts

are as accurate as expert assessments. While coherence in artificial

markets is of academic interest, competence in artificial markets

promises real societal benefits in the form of cheap and reliable

forecasts. We now examine whether this stronger notion of efficiency

can hold in market games, by assessing the forecast accuracy of the

HSX stock and options markets (Section 4.1),

the HSX award options market

(Section 4.2), and the Foresight Exchange

market (Section 4.3).

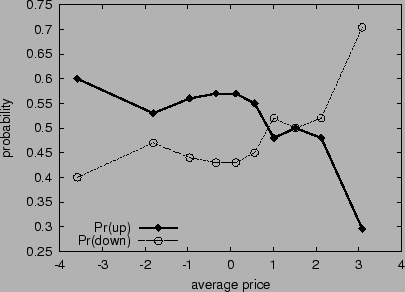

Box office forecasts: HSX movie stocks and options

Before a movie stock on HSX adjusts, its price constitutes an estimate

of 2.9 times the movie's opening weekend proceeds. We gathered the

halt prices  (Friday morning's prices) and adjust prices

(Friday morning's prices) and adjust prices  (2.9 times the actual return) for movies opening during the period

March 3, 2000 to September 1, 2000. We also collected the published

forecasts of Brandon Gray at Box Office Mojo.13 We quantify and compare HSX predictions to

Box Office Mojo predictions for 50 movies appearing on both sources.

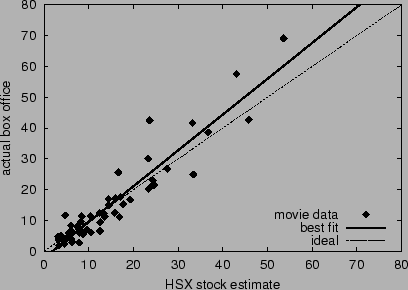

Figure 5 plots the actual box

office return

(2.9 times the actual return) for movies opening during the period

March 3, 2000 to September 1, 2000. We also collected the published

forecasts of Brandon Gray at Box Office Mojo.13 We quantify and compare HSX predictions to

Box Office Mojo predictions for 50 movies appearing on both sources.

Figure 5 plots the actual box

office return  versus the HSX estimate

versus the HSX estimate  for each

movie. The correlation between actual and estimate is 0.940. The slope

of the best-fit line to the data (the solid line in the figure) is

1.16, the mean absolute error is 3.57, and the mean percent error is

31.5%.

for each

movie. The correlation between actual and estimate is 0.940. The slope

of the best-fit line to the data (the solid line in the figure) is

1.16, the mean absolute error is 3.57, and the mean percent error is

31.5%.

Figure 5:

Accuracy of HSX movie stock forecasts for opening

weekend box office returns. The dashed line corresponds to ideal accuracy;

the solid line is the best linear fit.

|

The HSX options market provides an alternative forecast for opening

weekend returns. The quantity  , where

, where  and

and  are

the call and put halt prices, should coincide with

are

the call and put halt prices, should coincide with  , due to

put call parity. When actual returns are plotted against this options

estimate, the correlation is 0.931, the best-fit line's slope is 1.12,

the mean absolute error is 3.38, and the mean percent error is 47.0%.

, due to

put call parity. When actual returns are plotted against this options

estimate, the correlation is 0.931, the best-fit line's slope is 1.12,

the mean absolute error is 3.38, and the mean percent error is 47.0%.

Notice that for both stock and options estimates, there is a slight

bias to underprice the best-performing movies and overprice the

worst-performing movies. This may be explainable as a manifestation of

risk-seeking behavior among HSX participants: traders prefer potential

``sleepers'' with a low probability of a very large payoff, rather

than known quantities with a high probability of a moderate

payoff. Since payoffs are not in real money, and since motivations may

be to sell out on Ebay, or to get onto the leader board quickly, one

might expect to see risk-seeking behavior.

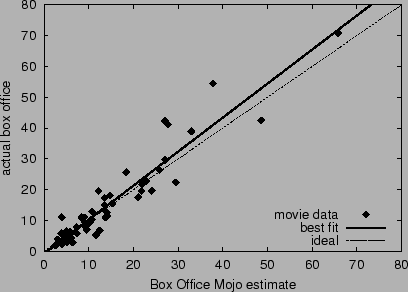

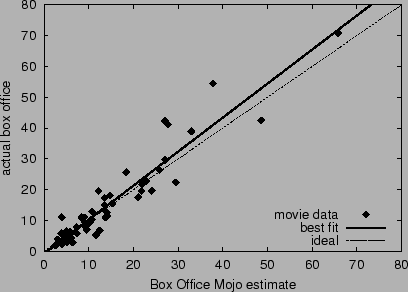

Figure 6 displays actual returns

versus Box Office Mojo forecasts.14

The correlation is 0.945, the best-fit line's slope is 1.10, the mean

absolute error is 3.31, and the mean percent error is 27.5%. Box

Office Mojo performed only 4% better than HSX stocks in terms of mean

percent error. The correlation in errors between HSX estimates and Box

Office Mojo estimates is 0.818, suggesting that the two estimates may

result from overlapping sources of evidence. In fact, it is possible

that Box Office Mojo observes HSX prices, and/or that some HSX traders

read Box Office Mojo forecasts.

Figure 6:

Accuracy of Box Office Mojo forecasts for opening

weekend returns. The dashed line corresponds to ideal accuracy;

the solid line is the best linear fit.

|

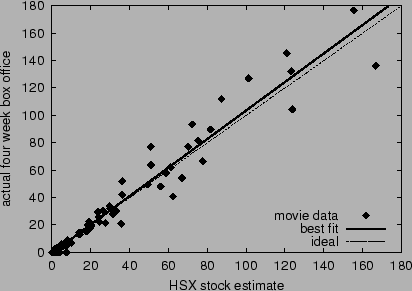

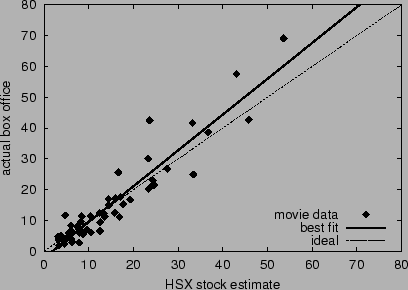

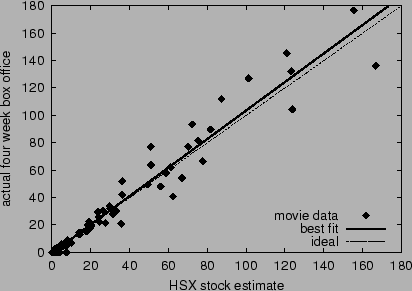

After a movie stock adjusts (or if it does not adjust), its price is a

forecast of the movie's four week total box office return  . We

gathered the delist prices

. We

gathered the delist prices  and the prices three weeks before

delist

and the prices three weeks before

delist  for 109 movies between March 3, 2000 to September 1,

2000. Figure 7 graphs

for 109 movies between March 3, 2000 to September 1,

2000. Figure 7 graphs  versus

versus  for each movie. The correlation is 0.978, the best-fit

line's slope is 1.04, and the mean error is 4.01.

for each movie. The correlation is 0.978, the best-fit

line's slope is 1.04, and the mean error is 4.01.

Figure 7:

Accuracy of HSX movie stock forecasts for four week total

box office returns. The dashed line corresponds to ideal

accuracy; the solid line is the best linear fit.

|

Probabilistic forecasts: HSX Award Options

In the HSX Oscar options market, as it turns out, each nominee with

the highest final price in its category did indeed win an Oscar. The

Wall Street Journal, amid controversy, published a poll of actual

Academy voters days before the Oscar awards ceremony; their report

correctly forecasted only seven out of eight winners.

Beyond predicting the most likely winner, we investigate how

accurately HSX award option prices reflect all likelihoods of

winning. For example, if prices are accurate, then among all options

with a normalized price of H$0.1, about one in ten should end up

winning. Our accuracy analysis is similar to that conducted for horse

races [1,18,19,20,22] and other

sports betting markets involving real money. We collected prices of

award options associated with the Oscars,

Grammies, and Emmies, for a total of

135

options. Grammy options (nine categories) and Emmy options (ten

categories) functioned exactly as Oscar options, though winning Grammy

options paid out H$42 instead of H$25.

Figure 8:

Accuracy of the HSX award options market. Points display

observed frequency versus average normalized price for buckets of

similarly-priced options. The dashed line where frequency equals

price corresponds to ideal accuracy.

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=hsx-a...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img32.png) |

Prices were recorded just before the markets closed, and before

winners were announced. We sorted the options by price, and grouped

them into six buckets. We placed the same number of options (16)

in every bucket, under the constraint that every bucket include at

least one winning option. We computed the average normalized price of

options within each bucket, and the observed frequency within

each bucket, or the number of winning options divided by the number of

options. Figure 8 plots each

bucket's observed frequency versus its average normalized price. If we

model options as independent Bernoulli trials, then, in the limit as

the number of options goes to infinity, completely accurate prices

would imply that bucket points fall on the line  , where observed

frequency equals price. Error bars display 95% confidence intervals

under the independent Bernoulli trials assumption. Specifically, the

lower error bound is the 0.025 quantile of a Beta distribution

corresponding to the observed number of successes (wins) and trials in

the bucket, and the upper error bound is the 0.975 quantile. The Beta

distribution is the correct posterior distribution over frequency,

assuming a uniform prior.15 The length of an error bar decreases as the number of

options in the bucket increases. The independence assumption is an

idealization, since options within a single award category are

actually mutually exclusive. The closeness of fit to the line

, where observed

frequency equals price. Error bars display 95% confidence intervals

under the independent Bernoulli trials assumption. Specifically, the

lower error bound is the 0.025 quantile of a Beta distribution

corresponding to the observed number of successes (wins) and trials in

the bucket, and the upper error bound is the 0.975 quantile. The Beta

distribution is the correct posterior distribution over frequency,

assuming a uniform prior.15 The length of an error bar decreases as the number of

options in the bucket increases. The independence assumption is an

idealization, since options within a single award category are

actually mutually exclusive. The closeness of fit to the line  can be considered a measure of the accuracy of HSX prices.

There is some indication of a favorite-longshot bias, although more

data is needed to verify. As in horse racing, this bias is potentially

explainable by assuming risk-seeking behavior among the participants.

can be considered a measure of the accuracy of HSX prices.

There is some indication of a favorite-longshot bias, although more

data is needed to verify. As in horse racing, this bias is potentially

explainable by assuming risk-seeking behavior among the participants.

We compare HSX prices of Oscar options to reported likelihood

assessments from five columnists at the Hollywood Stock Brokerage and

Resource (HSBR),16 a fansite of

HSX. We use the logarithmic scoring rule to rate the market and the

columnists. The logarithmic score is a proper scoring rule

[23], and is an accepted method of evaluating probability

assessors. When experts are rewarded according to a proper score, they

can maximize their expected return by reporting their probabilities

truthfully. Additionally, more accurate experts can expect to earn a

higher average score than less competent experts. Scores are computed

separately within each award category, then averaged. Index the five

nominees in a category

. Let

. Let  if and only if

the

if and only if

the  th nominee wins, and

th nominee wins, and  otherwise. let

otherwise. let

be the market's or columnist's reported probabilities for the

five nominees. Then the assessor's score for the current category is

be the market's or columnist's reported probabilities for the

five nominees. Then the assessor's score for the current category is

. Expert assessments were

reported on February 18,

2000. Table 1 gives the average

scores for the HSX market, the five columnists, and the consensus of

the columnists. Higher scores are better, with 0 the maximum and

negative infinity the minimum. Only one of the five experts scored

appreciably better than the market on February 18. HSX's score

increased almost continuously from the market's open on February 15 to

the market's close on March 26. By February 19, the market's score had

surpassed all of the scores for all five experts and for their

consensus.

. Expert assessments were

reported on February 18,

2000. Table 1 gives the average

scores for the HSX market, the five columnists, and the consensus of

the columnists. Higher scores are better, with 0 the maximum and

negative infinity the minimum. Only one of the five experts scored

appreciably better than the market on February 18. HSX's score

increased almost continuously from the market's open on February 15 to

the market's close on March 26. By February 19, the market's score had

surpassed all of the scores for all five experts and for their

consensus.

Table 1:

Evaluation of HSX Oscar forecasts and

HSBR columnists' forecasts, according to average logarithmic score.

Higher (less negative) scores are better.

| assessor |

score |

| Feb 18 HSX prices |

-1.08 |

| Feb 19 HSX prices |

-0.854 |

| Tom |

-1.08 |

| Jen |

-1.25 |

| John |

-1.22 |

| Fielding |

-1.04 |

| DPRoberts |

-0.874 |

| columnist consensus |

-1.05 |

|

Foresight Exchange

Hanson [8,9] proposes what he calls an

Idea Futures market, where participants trade in securities

that pay off contingent on future developments in science, technology,

or other arenas of public interest. For example, a security might pay

off US$1 if and only if a cure for cancer is discovered. He argues

that the reward structure of such a market encourages honest

revelation of opinions among scientists, and provides more accurate

probability assessments for use by funding agencies, public policy

leaders, the media, and other interested parties. The concept is

operational as a web game called the Foresight Exchange

(FX).17 There are

currently on the order of 3000 registered participants and 200 active

claims. Players start with an initial amount of ``FX bucks'' and

receive an allowance every week, up to a certain maximum. Participants

can buy and sell existing claims, or submit their own claims. Each

claim is assigned a judge to arbitrate ambiguous wording, and to

ultimately determine whether the claim is true or not on the judgment

date. Claims range from technical (e.g., FX$1 if and only if an

algorithm for three satisfiability is developed with a particular

runtime complexity by the year 2020) to sociopolitical (e.g., FX$1 if

and only if Japan possesses nuclear missiles by 2020) to irreverent

(e.g, FX$1 if and only if Madonna names her first child Jesus). The

developers of the site intend for the prices of these claims to be

interpreted as assessments of the probabilities of the various events.

Figure 9:

Accuracy of the Foresight Exchange market. Prices are 30

days before claim expiration. Points display observed frequency

versus average price. The dashed line corresponds to ideal

accuracy.

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=if-ac...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img42.png) |

To determine how accurate these assessment are, we collected

historical price information for all retired (completed) claims as of

September 8, 2000. Of these, we retained only the 172 that were binary

(i.e., paid off if and only if some true-or-false event occurred).

We recorded the price of each claim 30 days before it expired. A total

of 161 claims were active for at least 30 days, and thus qualified for

this data set. We sorted the claims by their 30-day-before-expiration

price, grouped them into six buckets of constant size 17 (under the

constraint that every bucket contain at least one winning claim), and

computed the average price and observed frequency for each bucket.

Figure 9

graphs the results.

Error bars show 95% confidence intervals based on the assumption that

claims are independent Bernoulli trials with a uniform prior over

frequency.

The World Wide Web fosters large-scale group activities of all sorts,

from competing in games, to trading in markets, to competing in market

trading games.

But beyond their entertainment value, are there any societal benefits

to artificial markets? Despite their lack of grounding in tangible

assets, both the Hollywood Stock Exchange (HSX) and the Foresight

Exchange (FX) show signs of efficiency, manifested as price coherence

and forecast accuracy. In absolute terms, HSX provides informative box

office forecasts, while both HSX and FX provide prescient likelihood

assessments of uncertain events. In direct and limited comparisons

with expert judges, both types of HSX forecasts perform

competitively. Relative to a real-money market, arbitrage closure on

HSX appears qualitatively similar, though quantitatively much weaker.

What are the implications of these results? For one, interested

parties can mine existing market simulations for information, with

some reassurance as to accuracy. Alternatively, they can open new

artificial markets, with relatively few impediments, as a mechanism

for gathering information in areas of personal concern or

interest. Economics researchers may also open market games in order to

carry out experiments that would otherwise be too costly or too

difficult. The analyses bear upon the psychology of incentives for

intangibles, and begin to investigate what is needed, at a minimum, in

order for beneficial economic properties to emerge from group

interactions.

We thank William Walsh, Michael Wellman, Yan Chen, and Chris Meek for

advice, insightful comments, and pointers to related work. Thanks to

Eric Glover for research and programming assistance. Thanks to James

Pancoast and ``Jimmy Impossible'' from the Hollywood Stock Brokerage

and Resource (http://www.hsbr.net/), a fansite of HSX, and to

Ken Kittlitz from the Foresight Exchange.

- 1

-

Mukhtar M. Ali.

Probability and utility estimates for racetrack bettors.

Journal of Political Economy, 85(4):803-816, 1977.

- 2

-

Kenneth J. Arrow.

The role of securities in the optimal allocation of risk-bearing.

Review of Economic Studies, 31(2):91-96, 1964.

- 3

-

Jacques H. Dreze.

Market allocation under uncertainty.

In Essays on Economic Decisions under Uncertainty, pages

119-143. Cambridge University Press, 1987.

- 4

-

Robert Forsythe and Russell Lundholm.

Information aggregation in an experimental market.

Econometrica, 58(2):309-347, 1990.

- 5

-

Robert Forsythe, Forrest Nelson, George R. Neumann, and Jack Wright.

Anatomy of an experimental political stock market.

American Economic Review, 82(5):1142-1161, 1992.

- 6

-

Sanford J. Grossman.

An introduction to the theory of rational expectations under

asymmetric information.

Review of Economic Studies, 48(4):541-559, 1981.

- 7

-

Robin Hanson.

Consensus by identifying extremists.

Theory and Decision, 44(3):293-301, 1998.

- 8

-

Robin Hanson.

Decision markets.

IEEE Intelligent Systems, 14(3):16-19, 1999.

- 9

-

Robin D. Hanson.

Could gambling save science? Encouraging an honest consensus.

Social Epistemology, 9(1):3-33, 1995.

- 10

-

Robert E. Lucas.

Expectations and the neutrality of money.

Journal of Economic Theory, 4(2):103-24, 1972.

- 11

-

Andreu Mas-Colell, Michael D. Whinston, and Jerry R. Green.

Microeconomic Theory.

Oxford University Press, New York, 1995.

- 12

-

Richard D. McKelvey and Talbot Page.

Common knowledge, consensus, and aggregate information.

Econometrica, 54(1):109-127, 1986.

- 13

-

Richard D. McKelvey and Talbot Page.

Public and private information: An experimental study of information

pooling.

Econometrica, 58(6):1321-1339, 1990.

- 14

-

Lars Tyge Nielsen, Adam Brandenburger, John Geanakoplos, Richard McKelvey, and

Talbot Page.

Common knowledge of an aggregate of expectations.

Econometrica, 58(5):1235-1239, 1990.

- 15

-

C. R. Plott, J. Wit, and W. C. Yang.

Parimutuel betting markets as information aggregation devices:

experimental results.

Technical Report Social Science Working Paper 986, California

Institute of Technology, April 1997.

- 16

-

Charles R. Plott and Shyam Sunder.

Efficiency of experimental security markets with insider information:

An application of rational-expectations models.

Journal of Political Economy, 90(4):663-98, 1982.

- 17

-

Charles R. Plott and Shyam Sunder.

Rational expectations and the aggregation of diverse information in

laboratory security markets.

Econometrica, 56(5):1085-1118, 1988.

- 18

-

Richard N. Rosett.

Gambling and rationality.

Journal of Political Economy, 73(6):595-607, 1965.

- 19

-

Wayne W. Snyder.

Horse racing: testing the efficient markets model.

Journal of Finance, 33(4):1109-1118, 1978.

- 20

-

Richard H. Thaler and William T. Ziemba.

Anomalies: Parimutuel betting markets: Racetracks and lotteries.

Journal of Economic Perspectives, 2(2):161-174, 1988.

- 21

-

Hal R. Varian.

The arbitrage principle in financial economics.

J. Economic Perspectives, 1(2):55-72, 1987.

- 22

-

Martin Weitzman.

Utility analysis and group behavior: An empirical study.

Journal of Political Economy, 73(1):18-26, 1965.

- 23

-

Robert L. Winkler and Allan H. Murphy.

Good probability assessors.

J. Applied Meteorology, 7:751-758, 1968.

The Power of Play: Efficiency and Forecast Accuracy in Web Market Games

This document was generated using the

LaTeX2HTML translator Version 2K.1beta (1.48)

Copyright © 1993, 1994, 1995, 1996,

Nikos Drakos,

Computer Based Learning Unit, University of Leeds.

Copyright © 1997, 1998, 1999,

Ross Moore,

Mathematics Department, Macquarie University, Sydney.

The command line arguments were:

latex2html -split 0 market-sim-letter-extended.tex

The translation was initiated by David Pennock on 2001-02-17

Footnotes

- ... Nielsen1

- This work conducted while visiting the NEC Research Institute.

- ...Arrow64,Dreze87,MasColell95.2

- Pareto efficiency, a

common and mild assumption, implies no-arbitrage.

- ... otherwise.3

- Insurance contracts,

futures, options, derivatives, and even stocks can be modeled as

portfolios of such atomic securities.

- ...

(IEM)4

- http://www.biz.uiowa.edu/iem/

- ...

Canada5

- http://esm.ubc.ca

- ... Austria.6

- http://ebweb.tuwien.ac.at/apsm/

- ... (HSX)7

- http://www.hsx.com/

- ... Ebay8

- http://www.ebay.com/

- ...

Inc.9

- http://www.entdata.com/

- ...

returns.10

- Although cash holdings do accrue interest on HSX,

all analyses in this paper ignore any time value of Hollywood

dollars.

- ... millions).11

- Movies released on holiday

weekends, and movies with substantial box office receipts prior to

wide release, may adjust differently.

- ... profit.12

- In practice, the hedge is not quite so

perfect: movie options cash out based on the final box office numbers

reported on Monday, while movie stocks adjust according to the box

office estimates reported on Sunday, which are projections based on

Friday and Saturday returns only.

- ... Mojo.13

- http://boxofficemojo.com/

- ... forecasts.14

- Actual returns reported on

Box Office Mojo occasionally differed slightly from those reported on

HSX. We measured each forecaster against its own reported returns.

- ... prior.15

- Note that the expectation of the

Beta distribution,

, does not coincide precisely with the

observed frequency,

, does not coincide precisely with the

observed frequency,  , where

, where  is the number of successes and

is the number of successes and

the number of trials. However, as

the number of trials. However, as  grows, the two measures

converge.

grows, the two measures

converge.

- ... (HSBR),16

- http://www.hsbr.net/

- ...

(FX).17

- http://www.ideafutures.com/

David Pennock

2001-02-17

![]() ,

which is a crude estimate of the movie's opening weekend return

,

which is a crude estimate of the movie's opening weekend return

![]() . On the Friday of opening weekend, options trading is halted; on

the following Monday, call options delist and cash out at a price

equal to the weekend proceeds (in millions) minus the strike price, or

zero if this quantity is negative (i.e.,

. On the Friday of opening weekend, options trading is halted; on

the following Monday, call options delist and cash out at a price

equal to the weekend proceeds (in millions) minus the strike price, or

zero if this quantity is negative (i.e.,

![]() ). Put

options cash out at

). Put

options cash out at

![]() . A high call price (resp., a high

put price) suggests that, according to HSX participants, the movie

will earn more (less) than the strike price during its opening

weekend.

. A high call price (resp., a high

put price) suggests that, according to HSX participants, the movie

will earn more (less) than the strike price during its opening

weekend.

![]() , where

, where ![]() ,

,

![]() ,

, ![]() , and

, and ![]() are the stock, strike, call, and put prices,

respectively. Consider the value of the following two portfolios: (1)

twenty nine call options plus H$29

are the stock, strike, call, and put prices,

respectively. Consider the value of the following two portfolios: (1)

twenty nine call options plus H$29![]() in cash, and (2) twenty nine

put options plus 10 shares of the stock. After the weekend, portfolio

1 will be worth

in cash, and (2) twenty nine

put options plus 10 shares of the stock. After the weekend, portfolio

1 will be worth

![]() while

portfolio 2 will be worth

while

portfolio 2 will be worth

![]() . Since the two portfolios pay off equivalently, their prices at

any time before the weekend should be equal; otherwise, a trader can

buy the cheaper portfolio and short sell the other, locking in a

guaranteed profit.12

. Since the two portfolios pay off equivalently, their prices at

any time before the weekend should be equal; otherwise, a trader can

buy the cheaper portfolio and short sell the other, locking in a

guaranteed profit.12

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=hsx-a...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img18.png)

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=hsx-a...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img32.png)

![]() . Let

. Let ![]() if and only if

the

if and only if

the ![]() th nominee wins, and

th nominee wins, and ![]() otherwise. let

otherwise. let

![]() be the market's or columnist's reported probabilities for the

five nominees. Then the assessor's score for the current category is

be the market's or columnist's reported probabilities for the

five nominees. Then the assessor's score for the current category is

![]() . Expert assessments were

reported on February 18,

2000. Table 1 gives the average

scores for the HSX market, the five columnists, and the consensus of

the columnists. Higher scores are better, with 0 the maximum and

negative infinity the minimum. Only one of the five experts scored

appreciably better than the market on February 18. HSX's score

increased almost continuously from the market's open on February 15 to

the market's close on March 26. By February 19, the market's score had

surpassed all of the scores for all five experts and for their

consensus.

. Expert assessments were

reported on February 18,

2000. Table 1 gives the average

scores for the HSX market, the five columnists, and the consensus of

the columnists. Higher scores are better, with 0 the maximum and

negative infinity the minimum. Only one of the five experts scored

appreciably better than the market on February 18. HSX's score

increased almost continuously from the market's open on February 15 to

the market's close on March 26. By February 19, the market's score had

surpassed all of the scores for all five experts and for their

consensus.

![\begin{figure}

\begin{center}

\centerline{\scalebox{0.75}{\epsfig{file=if-ac...

...udegraphics[width=14cm]{hsx-oscar-arbitrage.eps}

\end{center}

\end{figure}](img42.png)