In Science 291:

987-988, February 9 2001 (Letters)

Assessing the probabilities of future events is a problem often faced

by science policymakers. For example, CERN, the European laboratory

for particle physics, recently had to judge whether the probability of

discovering a Higgs boson was high enough to justify extending the

operation of its collider (see Science, 22 Sept., p. 2014 and

29 Sept., p. 2260). At the Foresight Exchange (FX) Web site (http://www.ideosphere.com/),

traders can actually bet on the outcomes of unresolved scientific

questions, including whether physicists will discover the Higgs boson

by 2005. The going price of the security (0.77 as of 24 Jan) can be

seen as the market's assessment of the probability of the particle's

discovery. FX is only a game, run with play money (FX

dollars). Empirical studies [1], laboratory

investigations [2], and policy

proposals [3]

argue that prices of real-money securities do constitute accurate

likelihoods, since traders have strong (monetary) incentives to

leverage pertinent information. But can we place legitimate credence

on the accuracy of FX prices, which are determined solely through

competition in a play-money market game?

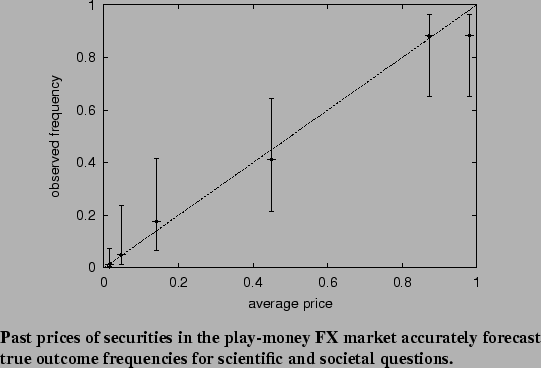

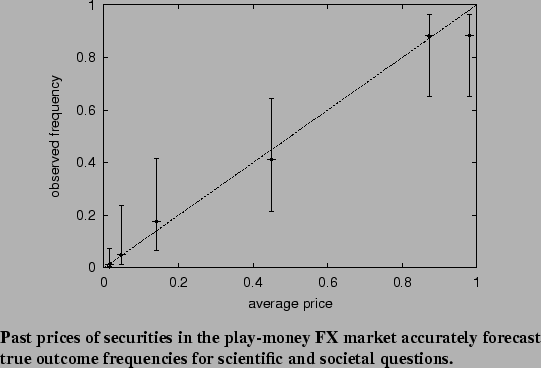

To an extent, yes. We find that FX prices strongly correlate with

observed outcome frequencies. We collected historical price

information for 161 expired securities, corresponding to questions

that had been definitively answered ``yes'' or ``no'', recorded prices

thirty days before expiration, sorted securities by price, and grouped

them into six price ranges. The figure plots observed frequency (the

actual number of ``yes'' securities divided by the total number)

versus average price (in FX dollars) for each group. Error bars

display 95% confidence intervals, under an assumption that outcomes

are independent Bernoulli trials with a uniform prior. We find similar

accuracy in another play-money market called the Hollywood Stock

Exchange (http://www.hsx.com/). Prices of

securities in Oscar, Emmy, and Grammy awards correlate well with

actual award outcome frequencies, and prices of movie stocks

accurately predict real box office results.

NEC Research Institute, 4 Independence Way, Princeton, NJ 08540, USA.

E-mail:

{dpennock,lawrence}@research.nj.nec.com.

School of Information Sciences and Technology and Department of Computer Science and Engineering, Pennsylvania State University,

University Park, PA 16801, USA. E-mail: giles@ist.psu.edu.

Finn Årup Nielsen

Informatics and Mathematical Modelling, Technical University of Denmark, DK-2800 Lyngby, Denmark. E-mail: fn@imm.dtu.dk.

- 1

-

R. Forsythe, T. A. Rietz, T. W. Ross,

Journal of Economic Behavior and Organization 39, 83

(1999).

- 2

-

C. R. Plott and S. Sunder,

Econometrica 56(5), 1085 (1988).

- 3

-

R. D. Hanson,

Social Epistemology 9(1), 3 (1995).

This document was generated using the

LaTeX2HTML translator Version 2K.1beta (1.48)

Copyright © 1993, 1994, 1995, 1996,

Nikos Drakos,

Computer Based Learning Unit, University of Leeds.

Copyright © 1997, 1998, 1999,

Ross Moore,

Mathematics Department, Macquarie University, Sydney.

The command line arguments were:

latex2html -split 0 market-sim-letter-final.tex

The translation was initiated by David Pennock on 2001-02-17

David Pennock

2001-02-17